Drawing on our extensive financial reporting expertiseples

Annual Transactions Report of Grant Thornton Israel

Executive Summary-Recap of 2021

Growth in the transaction market – Following the stability of the transaction’s market during COVID-19 pandemic crisis in 2020, the Israeli’s transaction’s market keeps hitting new records.

Throughout 2021, the volume of the total transactions (M&A and investment transactions) kept growing, reaching to 36 billion dollars.

An increase of 100% in comparison to 2020. Transaction value – The median transaction value in 2020 was about $30 million, higher than in previous years. High rate of large-size transactions – The number of large transactions (between $50 to $1 billion dollars) executed in 2021 was 188, about 120% higher in comparison with 2020.

TASE activity – In the first 11 months of 2021 89 IPOs were issued, mostly tech companies. An upward trend starting from November & December of 2021 with a total of 13 IPOs that were issued.

In September 2021 the permanent FDA’s approval of Pfizer’s COVID-19 vaccination and the use of the third vaccination in Israel, had a positive effect on the trade activity in TASE.

International comparison– The number and amount of the total transactions in Israel was indicating a substantial growth in 2021. As well, a significant growth was shown in developed European countries.

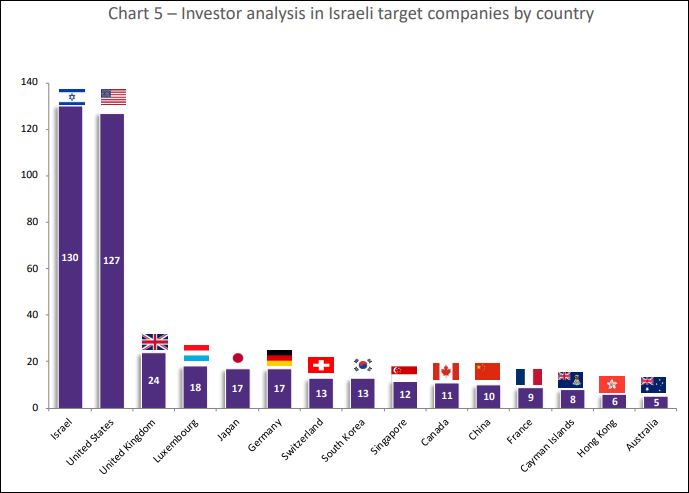

Foreign investors still believe in the Israeli technology – American investors are still the main buyers of Israeli companies’ acquisitions, they were involved in 219 transactions of Israeli companies. The main European investors of 2021, are from: UK, Germany, France and Switzerland. each one were involved in average of 30 transactions of Israeli companies.

The main Asian investors of 2021, are from: Singapore, China, Japan, South-Korea and Hong-Kong. each one were involved in average of 19 transactions of Israeli companies Industry analysis – The technology industry is the leading destination for investments in the Israeli market. About 78% of transactions are technologically oriented.

click here to continue reading [ 1678 kb ]